The Outlet of Opportunity

Gareth Jordan, Director at Art Software Group chatted with Andrew Duncan, Head of Placemaking, Marketing and Communications at Realm, at this year’s Retail Destination Live. Here’s a transcript of their discussion about the outlet sector.

GARETH: In the early days, outlets were very much about discounting. They were a vehicle for stock clearing and possibly even a channel that brands didn’t want to communicate about early on. How has that changed?

ANDREW: Outlets in the UK have been around since the early ‘90s. They originated as a factory clearance operation – they were quite down and dirty, with low retail standards and were really just trading on price. There was lots of red point of sale! From there, we’ve been through quite a lot of phases. We’ve got – depending on your definition – between 30 and 40 outlets. Outlets now have come of age as they are much more about delivering an experience and less about bleating on about ‘70% off’ because that becomes boring and tone deaf, particularly in the current

environment. People want a genuine experience. And there are a lot of things going for outlets which means they can deliver to quite a broad pantheon of consumers.

GARETH: Is there a specific culture emerging around outlets?

ANDREW: Everyone says that we need to work much more collaboratively, and in outlets that feels real. That is because it’s underwritten by the lease, in the structure of a turnover rent. But there’s a limit to partnership and how much are

you actually prepared to share if you’re a tenant? Are you really going to share how much you took last Thursday, between 4pm and 7pm, in your busiest stores? Well, if you have a turnover lease, then that is effectively a gateway, and it removes that adversarial nature of the landlord and tenant. And so, outlets, from their very inception, have had

to use everything that they possibly can to give the retail dynamic the best possible chance of success.

And you can’t get much more fundamental than the actual nature of the business relationship, because when it works well, it’s a win-win. So, we’re not talking about 10- or 25-year leases, we’re not talking about rent going up every year, or every time, there’s a rent review, we’re talking about something that’s basically hardwired to optimise the entire enterprise.

GARETH: And when you do have that structure in place, how do you address challenges collectively and this sharing of information, how is it applied?

ANDREW: A lot of retailers internally are very competitive. We turn the whole enterprise into one where initiative is rewarded, we are much closer to our retailers. And therefore, by definition, there’s a shared sense of responsibility to make the entire enterprise as successful as possible. We have our own internal league tables: we are sharing best

practice. Yes, it’s a property asset. And yes, it has property investors, But it’s a retail enterprise that ultimately is run by retailers for retailers. And it’s that level playing field of who doesn’t want to take more money because the landlord will be happy because there’s an increase in turnover, the store manager will be happy because they will go up the

league tables. And this sort of win-win situation just feels perfectly engineered for optimising physical retail in this day and age.

GARETH: In terms of the current economic situation, how is that affecting outlets?

ANDREW: Well, we are obviously seeing inflationary increases in lots of things, but for outlets it is clearly a big opportunity for us to try and gain market share. It’s something that we’re seeing with increased visitation.

Outlets do offer that value, but it’s not just about a sea of red POS and discounts, it does still check the boxes for delivering an experience. And all of the other factors that people want when they put the key in their ignition and set off for a day or a half day out.

GARETH: In the next slide, you have chosen farming as an analogy, why is that?

ANDREW: It feels to me that the industry needs to really grasp the nettle, and really look a little bit further afield at some of the solutions to try and engage a younger audience. And one of the ways to do that is to look at the advantages of data. And the reason why farming is such an interesting example is that in the 1960s, there were three billion people, now here we are in 2023, approaching 8 billion people. A massive, increase. And you think, how are all these people being fed? Well, if you look at the amount of land that is being given over to growing food that we

can eat, it has stayed constant virtually since 1960 but there is more food thanks to optimising yield. And it just seemed to me, that’s a really good example. Shopping centres need a sense of place and engagement with the community but ultimately, they’re about business. They are where money changes hands. And we’re looking at the same metric that farmers use: yield. So how much money is being generated? How is a retailer doing. If you go back to the turnover lease, that is hardwired in. This is ultimately where I think outlets have something to give, they are much more flexible, the lease length is a lot shorter and that frees up the decision making.

GARETH: You’ve been immersed in data for some time now, but what are the key metrics that you would pull out if you were starting out now?

ANDREW: Well, there’s the adage in business that turnover is vanity, profit is sanity and cash is reality. Well, you could argue now, that footfall is probably a pretty meaningless statistic, because obviously footfall has dropped. We’ve got the advent of purposeful shoppers, so all of those people wafting in and out of malls. With the advantage of a turnover lease, you can actually start to measure conversion, because you can have counters on individual stores, you can then correlate that with the amount of money going through the tills, you can then actually start to also look at average transaction values, which again, gives us a metric and gives us a handle on the impact of inflation, and also the total basket size. I’m using retailer language but, ultimately, I am an operator of a bricks and mortar asset. And so, I feel that the metrics ultimately are about the attractiveness. You could argue that that’s a function of footfall which everyone will be collecting. Then there’s obviously turnover, but it’s getting to that next level of detail, that ultimately helps you 0work with the retailers. You can say, ‘You know what, you guys have just opened a store. If we look at your category performance versus the other menswear stores, you’re just not getting enough market share or, you know,

you’re getting too many people going into your store, and they’re not actually converting’. You can have that conversation, because you’ve got the right relationship to say ‘why don’t you consider getting a different price point or changing your range?’ Retail is one of the most innovative and responsive industries. And it just feels that the sector with its institutional bias, and long 25-year leases and business relationships, is losing that ability to actually get down and dirty, and influence to optimise performance.

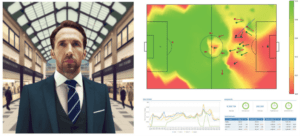

GARETH: Our next slide shows Gareth Southgate and we know football managers have a good grasp of statistics. We’ve also got a heat map of a football pitch. Let’s talk about that

ANDREW: The reason why we’re looking at football is because of the structure. Gareth is our national team’s manager, but every football team in the land now has a different set-up. A piece of paper with a business relationship on

its own is not going to change anybody’s fortunes. You actually need to embrace the set-up. And so, if we stick with football, the manager will have three disciplines. Number one, fitness or performance. So, there will be somebody there responsible for making sure that that team are ‘fitting up’. Apply that analogy to retail and employ somebody who

makes sure that their retailers are absolutely hitting it off the park, are their retail standards high enough? Are they delivering the best customer service?

The next thing is recruitment. Every football manager has somebody developing their pipeline from their academy players, so they are effectively a leasing manager. They are making the decisions to say what we need to plug this gap is an XYZ retailer.

And then the last one is the strategy manager. Every football manager will have somebody who will be analysing the data. And ultimately, particularly in the outlet sector, that is an asset manager, it’s invariably somebody with a retail background that can use the data not operationally on a day-to-day basis, but at a far more strategic level.

GARETH: Is it always worth that investment in getting the right people?

ANDREW: It’s much easier to justify the investment in headcount because everything is out in the open. I can’t tell you hand on heart that you will add 10% to the turnover of a shopping centre. But what I can tell you is that there is a direct relationship between hours invested, relationships built and performance. And we’ve got a track record where newcomers have come into the outlet sector in a pop-up or a 12-month basis. And they’ve been optimised and then they’ve converted, and then the next stage is that they’ve been upsized.

GARETH: So, it’s not only about getting the right people and the right data. It’s a combination of a number of things?

ANDREW: Yes! A favourite random stat of mine is that Aldi was 24 hours away from actually leaving the UK and packing up: they thought that they were not going to make any money. And then, obviously, came the advent of discount shopping. So it’s here to stay. But I think the level of sophistication is up. Outlets have done pretty well

out of borrowing from the hospitality, the leisure, the guest service, the entertainment, the art and culture sectors to really try and improve their proposition. And against that backdrop of a culture where initiative is rewarded. They’ve got stronger because of it.