Make it Swift: why the retail sector needs to utilise granular data

Huge events are driving consumer spend at nearby retail centres, but many landlords don’t have the data to understand the potential.

Dan Mason writes as guest author for Green Street News.

28 Oct 2024.

Across a record eight nights this summer, global sensation Taylor Swift performed a lung-busting three-hour set of her extensive back catalogue to 700,000 adoring fans from all over the world.

More recently, Anthony Joshua fought Daniel Dubois for the IBF World Heavyweight title, while over the coming months the Jacksonville Jaguars will play the New England Patriots as part of the NFL’s European games. The

England women’s football team will play Germany; Dua Lipa will perform during a leg of her Radical Optimism Tour; and, at long, long last, Oasis will grace the stage for the first time in 16 years.

What do these events have in common? Very little – apart from the fact that “Wembley Stadium Connected by EE” is the host for all of them.

Broad appeal

According to official data provided by Transport for London, more than 2.8 million people visited Wembley Park this summer, surpassing pre-Covid-19 pandemic footfall by 18% – which represents an all-time record. Herein lies the challenge for the manager of an asset connected to an events venue such as the London Designer Outlet, managed by Multi-Realm, which sits immediately adjacent to Wembley Stadium. How do you ensure the tenant mix across leisure, food and drink, fashion, and non-discretionary meets the needs of the very different attendees of these events? And how do you also ensure it remains attractive for the local shopper, or the tourist visiting from out of town?

“More than 2.8 million people visited Wembley Park this summer”

The same challenge is faced in various forms at other destinations, such as Lakeside Village with the Keepmoat stadium, and Resorts World Birmingham with its arena and the NEC. The answer to this question has to be data. But more than that, having the right people and processes in place to skillfully interpret live data to make informed

and strategic decisions. It is time for the retail property sector to open its eyes to the potential of data.

For example, currently in the UK on many major [shopping centre] transactions – which are not let with turnover based leases – the various investors and banks involved often only have general metrics to underwrite their proposed

investment decisions.

They mainly don’t have sight of how specific tenants are performing in real time, or the analysis to see how sales by tenant type are trending on a week-by-week basis. Consequently, the industry is reliant on the traditional valuation methodology which, without the granular trading data, will always involve more than a little guesswork.

Aligned to that, for any asset owner setting the capex programme, deciding where investment would have the most impact is one of the most important decisions on their to-do list. How do you do this if you do not fully understand

footfall dynamics, the flow through a venue, which stores are performing best on a day-to-day basis, and how all of this is shifting over time? Again, the only answer is to have live data to hand, and the people and systems to process it.

Savvy operators

Data is also crucial to maximising the day-to-day performance of an asset. For instance, our centre managers can see how weather, transport issues and consumer trends are impacting individual store performance across their asset,

and are empowered to speak to individual tenants about how they could tweak their range and product display, add lines of stock, or put in place measures for express ordering or check out to drive sales.

Our sophisticated use of data is making us savvy operators – it is enabling us to be efficient, prepared, and responsive. Using machine learning and experienced human interpretation, we’re getting better and better at predicting event impact and knowing what to do to maximise performance.

Clearly the elephant in the room here is how you gather the necessary data. Multi-Realm is an retail asset and property manager and has 25 years’ experience in operating designer outlets. The active asset management required in the outlet sector is regarded by many as a blue print for shopping centres. Outlets are traditionally let by way of turnover rents, and this both encourages a clear feedback loop between tenant and asset manager, but also allows all parties to make informed decisions. While other parts of the retail sector have been slower to shift from the older more traditional rental system, it is surely only a matter of time before leases which encourage the sharing of data become the norm.

However, the collecting data alone is not enough. The majority of our operational teams on site are retailers at heart; our centres are operated by former retailers for retailers, people who have run stores and operations and know both how tenants think and what is needed to profitably attract customers. Spending habits The key question is whether this approach makes a difference to performance, and the answer couldn’t be clearer. Multi-Realm has seen record-breaking trading at the London Designer Outlet in Wembley over the past 14 months, delivering its best-ever sales performance outside of December, with August surpassing £10m. This was driven by growing its fashion offer, an enhanced instore experience, and aligning the asset to a programme of best-in-class entertainment at Wembley Stadium – all complemented by the astute use of data.

“It is surely only a matter of time before leases which encourage the sharing of data become the norm”

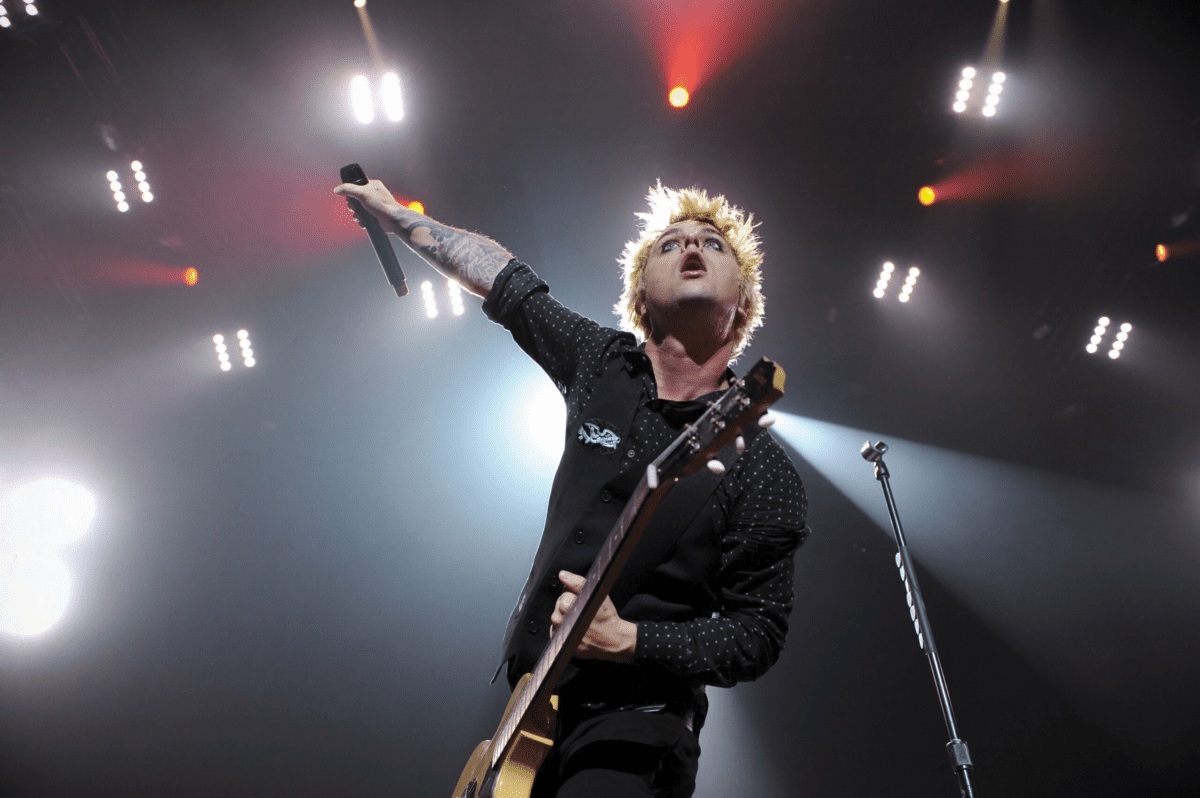

In case you were wondering, at Wembley, Green Day fans spent the most, with Taylor Swift, Harry Styles, and Ed Sheeran fans broadly spending the same. While a different venue also managed by Multi-Realm, at NEC Resorts World Birmingham attendees of Crufts outspent them all, including Girls Aloud fans. We always were a nation of dog lovers.